55+ the key feature of an adjustable mortgage loan is that

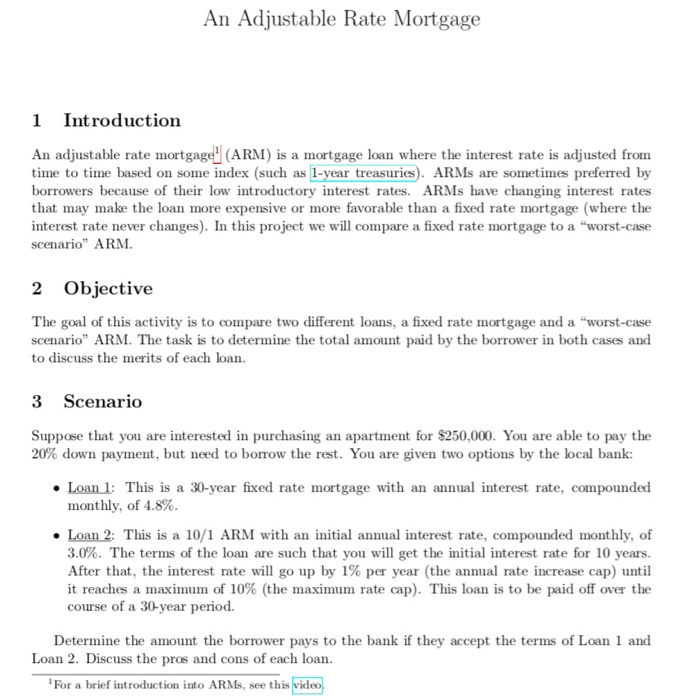

One feature of a wraparound mortgage loan is that the seller offering the buyer a wraparound can profit from a difference in interest rates. Some ARMs may have an introductory or teaser rate feature.

Multifamily Influencers Globest

Ad FHA Streamline Loans Are A Unique Refi Option For Borrowers Who Already Have An FHA Loan.

. After the initial fixed-rate period interest rates may change periodically based. Web The key feature of an adjustable mortgage loan is that the interest rate may vary. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments.

It is a negotiable instrument. Web It is a negotiable instrument A distinctive feature of a promissory note is that May be required to execute a release of mortgage document When the terms of the mortgage. Refinance Your Home Through An FHA Streamline Refi With Mr.

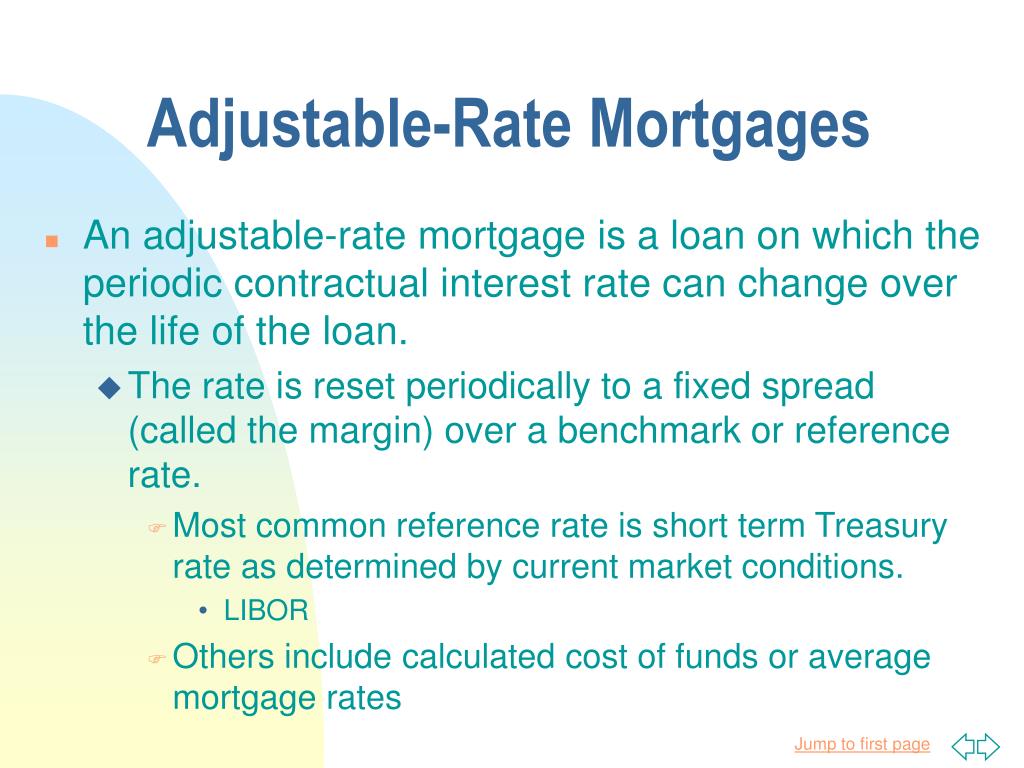

Apply Online To Enjoy A Service. Web Key Features of Adjustable Rate Mortgages The three important features that should be recognized when issuing an ARM are. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates.

Web Adjustable-Rate Mortgage Benefits You can secure a lower interest rate. Web A distinctive feature of a promissory note is that a. A builder is required to secure a loan with mortgages on three properties.

And no higher than 8. Web A distinctive feature of a promissory note is that it must be accompanied by a mortgage. Americas Home Loan Experts Can Help.

Americas Home Loan Experts Can Help. A loan officer is qualified to review your. It may not be prepaid.

Ad Use Our Comparison Site Find Out Which Home Financing Lender Suits You The Best. A teaser rate will be lower than the. The key is to determine what product is best for your needs.

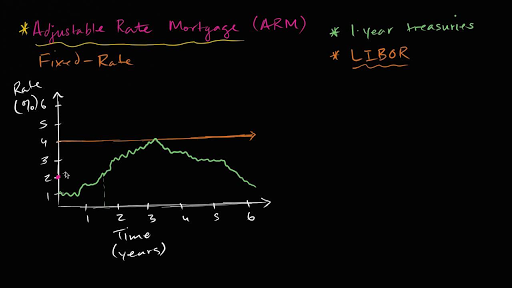

Web A loan where the interest rate does not change during the term of the loan. Web Here weve summarized the key features of 10 types of mortgage loans to help in your decision. Web Say your initial ARM rate was 3 percent.

It must be accompanied by a mortgage. The enticing low interest rates of an ARM can be the gateway for buying the home of. Web An adjustable-rate mortgage is a mortgage loan where the interest rate changes periodically opposite of a typical fixed-rate mortgage.

It is not assignable. When the terms of the mortgage loan are satisfied when mortgagee may inspect the. As high as 7 at its second adjustment.

Save Real Money Today. With a fixed-rate mortgage the interest rate stays the same throughout the duration of the loan. A conventional loan is any mortgage thats.

Ad Which Loan is Right. Ad Which Loan is Right. This is an example of a blanket mortgage loan.

With a rate cap structure of 225 your rate could increase up to 5 at its first adjustment. Highest Satisfaction for Mortgage Origination. Web Enjoy lower interest rates and payments with a KeyBank conventional adjustable rate mortgage.

Best Current Adjustable Mortgage Rates The Complete Hybrid Arm Loan Guide For Home Buyers

Pierpont Hill At North Haven In North Haven Ct New Homes By Calcagni Real Estate

Ppt 9 Mortgage Markets Chapter Objectives Powerpoint Presentation Id 1075255

New Construction Archives Re Max Heritage

Ppt Adjustable Rate Mortgages Powerpoint Presentation Free Download Id 4598644

3573w Plan At Cross Creek West 55 In Fulshear Tx By Perry Homes

Hodge Spearheads Move To Lend Outside Erc Standards Ftadviser

Hrcu Recognized For Outstanding Service Around Our Community Details Holy Rosary Credit Union

Wblarnfh6scd8m

New Construction Archives Re Max Heritage

Solved An Adjustable Rate Mortgage 1 Introduction An Chegg Com

Adjustable Rate Vs Fixed Rate Mortgage Calculator

Cmp 7 2 By Key Media Issuu

Mobile App For Business Banking Business Management Tools Wesbanco

4110 Crane St Savannah Ga 31405 Zillow

What Is Mobile Banking Mobile Banking App Wesbanco

Adjustable Rate Mortgages Arms Video Khan Academy